This article contains affiliate links. Learn more in our affiliate disclosure.

Travel insurance might be one of the most boring and annoying topics to think about before heading out to travel the world. Yet it’s one of the most important aspects of any trip. It’s very time-consuming to go through all the different options and find the best one for you.

Getting a bad tummy, finding yourself in a scooter accident, or having an unexpected tooth infection… This is just the beginning of the list of all the things that could go wrong.

Even in less developed countries, you might end up spending hundreds or thousands of dollars on unexpected medical expenses. So investing in good travel insurance is a MUST, even for all budget travelers. It can save you a loooot of money.

To make it a little easier, we would like to share with you our experience with SafetyWing and provide som basic info about their products and Nomad Insurance.

About SafetyWing and Nomad Insurance

SafetyWing is a relatively new travel insurance company based in the US. It was founded in 2018. What makes it really special, is that it’s almost entirely run by digital nomads. It mostly focuses on travel insurance products made for digital nomads and budget travelers.

SafetyWing provides well-covered insurance for a smaller cost when compared with its competitors. Moreover, it covers more than 180+ countries.

They offer Nomad Insurance, perfect for short-term travel, Nomad Health tailored for people who work and live abroad, and Remote Health, travel insurance for companies with remote teams.

However, in this review, we’ll only focus on their Nomad Insurance – a travel medical insurance.

What’s Nomad Insurance

Nomad Insurance is a product crafted for budget travelers and digital nomads. It’s one of the most affordable options, making it a popular choice. It’s great when unexpected situations occur. But it’s important to note that it’s a travel insurance, not a medical insurance.

That means it does not cover any pre-existing conditions or cancer treatment. Any regular check-ups, chronic conditions, and other similar healthcare needs are not included. It’s better to look into the Remote Health insurance.

It’s also not a good choice for everybody. If you’re traveling for less than a month, there are better choices out there. The Nomad Insurance is best for budget travelers looking for an essential coverage for a reasonable price.

What does SafetyWing Nomad Insurance cover?

SafetyWing’s Nomad Insurance will cost you from 56.28$ a month if your age is between 18 and 39. When choosing the best travel insurance, it’s also important to read the policy carefully and go through all the conditions.

This is what the SafetyWing Nomad Insurance covers.

Health:

- Unexpected sickness and injuries up to 250 000$

- Necessary return for medical reasons up to 5 000$

- Emergency dental treatment up to 1 000$

- Pocket money while hospitalized – 100$ per night

- Repatriation of remains if you die up to 20 000$

Travel:

- Unplanned overnight stay up to 100$ per night, up to 2 days

- Lost luggage after 10 day up to 3 000$

- Stolen passport up to 100$

- A trip interruption up to 5 000$

- Evacuation from a local unrest up to 10 000$ in your lifetime

- Liability (cost of damage to someone) up to 25 000$ in your lifetime

Nomad Insurance also includes a lot of sports. Read the list on the SafetyWing website to check whether the intended sport is included.

When comparing the coverage for unexpected medical emergencies with other travel insurance, 250 000$ is not much. You should aim for at least 1 000 000$. While it might seem like an excessive amount, the costs can add up quickly if you have serious injuries abroad.

Add-on packages

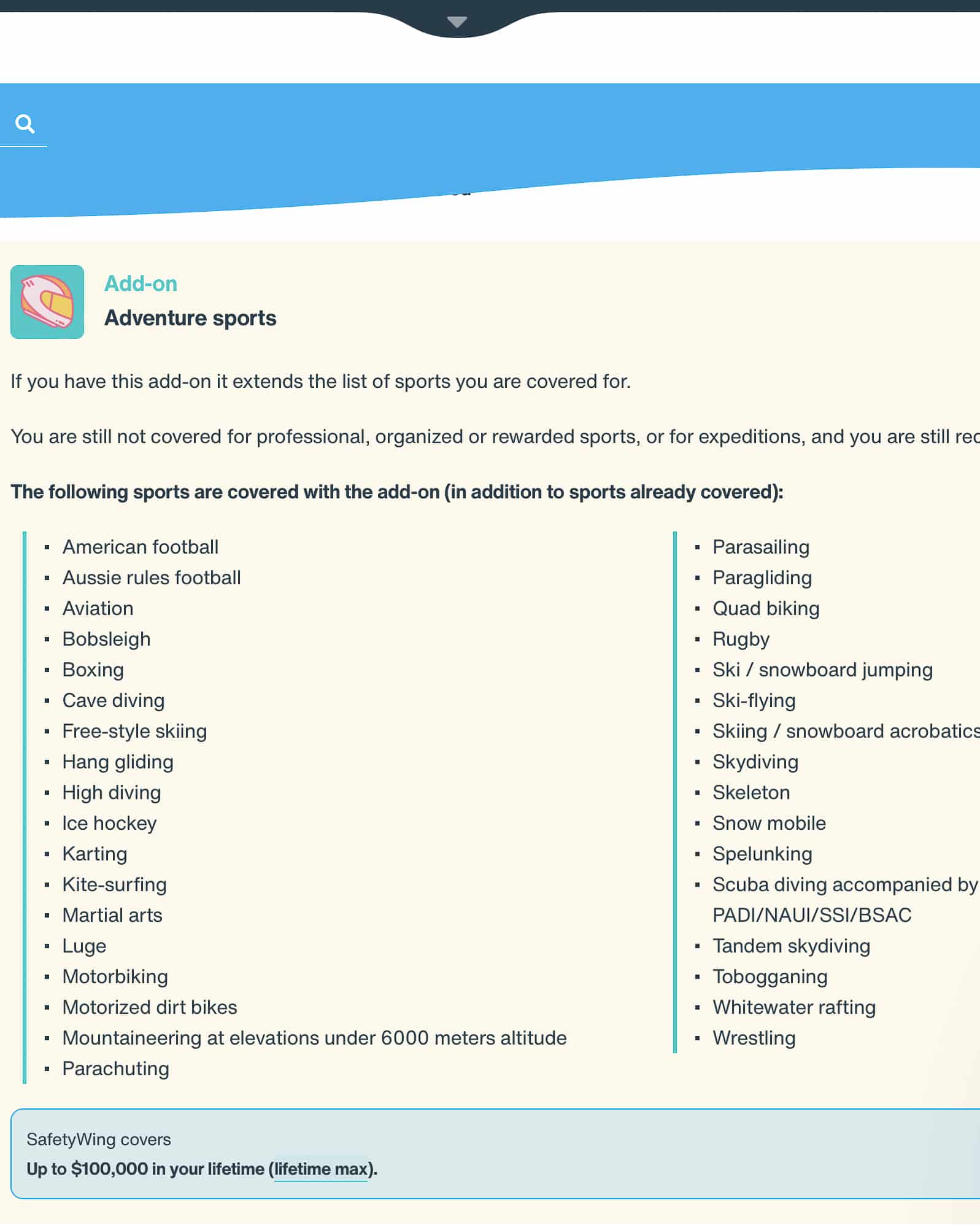

Adventure Sports is a great add-on for those planning an action-packed holiday full of different spots. Remember, you are not covered for professional, organized, or rewarded sports. Expeditions to remote places are also not part of the insurance’ s policy.

Theft coverage for electronics covers up to 1 000$ per electronics, with a maximum of 3 000$ per active insurance period. It includes stolen laptops, cameras, lens, drones, smartphones, tablets, earplugs and more.

Lastly, you can purchase a US add-on. It’s not available for US citizens. This add-on covers you during your US travel under the same conditions as outside the US. However, you’ll have to pay 100$ for an emergency room visit and 50$ for an urgent care center visit.

What’s NOT covered

The Nomad Insurance doesn’t cover the following:

- lost or stolen cash

- limited coverage for lost or stolen personal items

- delayed baggage

- trip cancellation

- pre-existing health conditions

- regular check-ups

- cancer treatment

- extreme sports (only with sports add-on)

- hiking and mountaineering over 6 000m (4 500m without sports add-on)

- illness or injury which happened as a result of substance abuse

Nomad Insurance pricing

To check the recent pricing for your age group, use the widget below. Getting a quote is completely free!

Our experience with SafetyWing

As soon as you open the SafetyWing website a modern and user-friendly design will welcome you. We love how everything is really clear and well-communicated. There’s no need to read hundreds of pages to understand the policies.

What we love the most is that SafetyWing’s pricing is also easy to understand and there are no hidden charges. We’ve been with them for a while now. Luckily, we only had to make a claim once. After all, while everyone should have travel insurance, no one really wants to use it, right?

Getting a dengue fever

So when we traveled to Thailand in 2023, we enjoyed our last few days on Koh Phangan island, exploring all its stunning beaches. It was during Thailand’s monsoon season. While we were prepared for malaria, we didn’t consider other mosquito diseases, such as Dengue.

Despite not really feeling bothered my many mosquitos, one day I woke up with a severe headache. I could not even lie down, because it hurt when my head was touching the pillow. After a day or two, my overall condition started to get worse.

Soon I had a fever and almost zero energy. I was not able to walk anywhere for more than a few minutes and had no will to eat. Soon, Juraj joined me, too. As it was not getting better at all, we decided to visit a hospital.

After getting tested, we were diagnosed with dengue fever. Luckily, hospitalization was not necessary. We got an infusion and lied in the hospital for a few hours. There’s no medication to treat dengue, the only thing that helps is paracetamol.

While the treatment was not that expensive, the cost of all the different tests added up to around 300$ for both of us. We made a claim and uploaded all the necessary documents, such as bills and medical reports.

The whole claim process felt really easy and the form worked well for us. Before too long, we received our money back without any troubles.

Pros of Nomad Insurance

- As of 2024, SafetyWing cancelled the 250$ deductible for non-US citizens. This makes the insurance plan even more affordable! Having to pay 250$ every time something happens out of your pocket can add up quickly.

- They have incredibly helpful and fast customer care, that replies in a few minutes via chat. If you’re not sure whether you’re eligible for a claim or what documents are necessary, they’ll answer all your questions. They’re also available 24/7.

- While a claim can last as long as 1.5 months, SafetyWing usually manages to take care of it in less than a week.

- You can also buy insurance after you leave your home when you’re already abroad.

- You can add one child between 14 days and 10 years old to the insurance policy without any extra cost.

- For every 90-day travel period, you are covered for an additional 30 days (15 days for US citizens) when visiting your home country. This includes any unforeseen medical expenses according to the policies.

- The claim submission process is easy.

- It’s one of the most affordable options.

- They have a 28-day renewal policy, which gives you a lot of freedom and there’s no need to set an end date for your trip.

- No limit on travel duration.

If you get in a scooter accident, you’re only covered for your own medical expenses. Unfortunately, any personal liability is not included. That means the insurance won’t cover the vehicle damages or injuries caused to a third person.

Cons of Nomad Insurance

- It doesn’t cover travel to Cuba, Iran, South Korea and Belarus.

- Not a good package for real digital nomads looking for comprehensive travel and medical insurance. In this case, take a look at Nomad Health.

- It is not available for people over 70.

- There’s no trip cancellation coverage.

- Limited electronics and personal belongings coverage.

- No direct billing, meaning you will have to pay everything out of your pocket before getting reimbursed. It also makes the claims a bit more time-consuming.

Final thoughts on SafetyWing Nomad Insurance

SafetyWing is one of the most affordable travel insurance for all the budget travelers out there. They provide excellent customer care and cover a lot of unexpected expenses.

While no one ever wants to get into a situation when you need to use your travel insurance, having one makes you feel more at ease. After years of traveling, we never leave our home without good insurance.

If you’re looking for a reliable company that’s easy to communicate with, SafetyWing won’t disappoint.

Thank you! 😇